“Powered by the BetFred Group”, claims traderfred.com, the official website of the Forex/CFD brokerage. The exact nature of the links between BetFred and TradeFred are unclear, but whatever they may be, if they do indeed exist, they certainly lend quite a bit of extra credibility and prestige to the brokerage. Until recently, TradeFred didn’t exactly make a strong impression on this front. Its only regulatory endorsement coming from Vanuatu’s VFSC, the operator looked like a bit of a lame duck.

Its entire business setup didn’t seem to make sense. Its headquarters in Manchester, the brokerage was supposed to focus on the EU market, but with only the VFSC license under its belt, it could not peddle its services in the EU. Not long ago, it became clear that the operation was merely waiting for its CySEC license to come through, and indeed, about a week or so ago, the license landed. Attesting the operator’s MiFID compliance, this license has enabled TradeFred to legally peddle its services in the EEA. What’s more, the regulation-linked ambitions of the operations extend to the eventual acquiring of a FCA license too. They also have a ASIC regulatory license which shows that TradeFred are here to stay.

The site observes strict KYC and AML policies and as part of this, it requires a number of documents from its users, to prove identity. These documents include color copies of passports, national ID cards and driver’s licenses. Furthermore, the site also tracks trading platform usage patterns, such as shared IP addresses, and the time it usually takes the user to place a trade. Users will be queried in regards to any unusual activity in their trading accounts.

The TradeFred Product Selection

In this regard, TradeFred do not exactly compete for industry-leading status, but they do feature a rather decent selection of tradable assets. Their Forex section stands out in this regard. Almost 50 currency pairs are supported, and the trading conditions are the best on the Forex pairs too. The maximum allowed leverage in this category is 1:500, which is – again – the best available leverage at the brokerage. The execution and spreads are said to be great on currency pairs, though the latter are fixed.

The maximum leverage is the lowest in the stocks section. Here, traders can only use 1:10 leverage at best. The actual asset selection is decent though.

On most tradable assets – including indices – the maximum leverage is 1:25. Only two precious metals can be traded: Gold and Silver. Platinum is also mentioned at the site, although on the page detailing the trading conditions associated with all supported assets, Platinum is not present in the precious metals category. Instead, it is included in the commodities section.

The Energies section covers natural gas and oil, while the commodities section includes agricultural assets such as wheat, sugar, soybeans, coffee, cocoa, copper and – as said above – platinum and palladium. Orange Juice is also available in this section. The maximum leverage on all the above named assets is 1:25.

TradeFred’s Resources

The Resources section is meant to give traders a handle on various economic events and to offer them trading signals. To this end, there’s a Daily Reviews section featured, which offers a sort of brief rundown of the day’s most important economic news. The Economic Calendar is indispensable for traders who rely on the fundamentals in their trading strategy.

Trade Signals are perhaps the most interesting resources available here. These trading signals are essentially trade recommendations, which are based on a number of economic indicators, such as trading volumes, market activity, interest rates and various chart patterns, identified as trading opportunities through technical analysis.

In regards to TradeFred’s signal service, it has to be noted that these signals are delivered from a 3rd party, so the brokerage does not accept any responsibility for their accuracy, or for the trader losses resulting from their use. According to TradeFred, the signals should not be considered investment advice in any way.

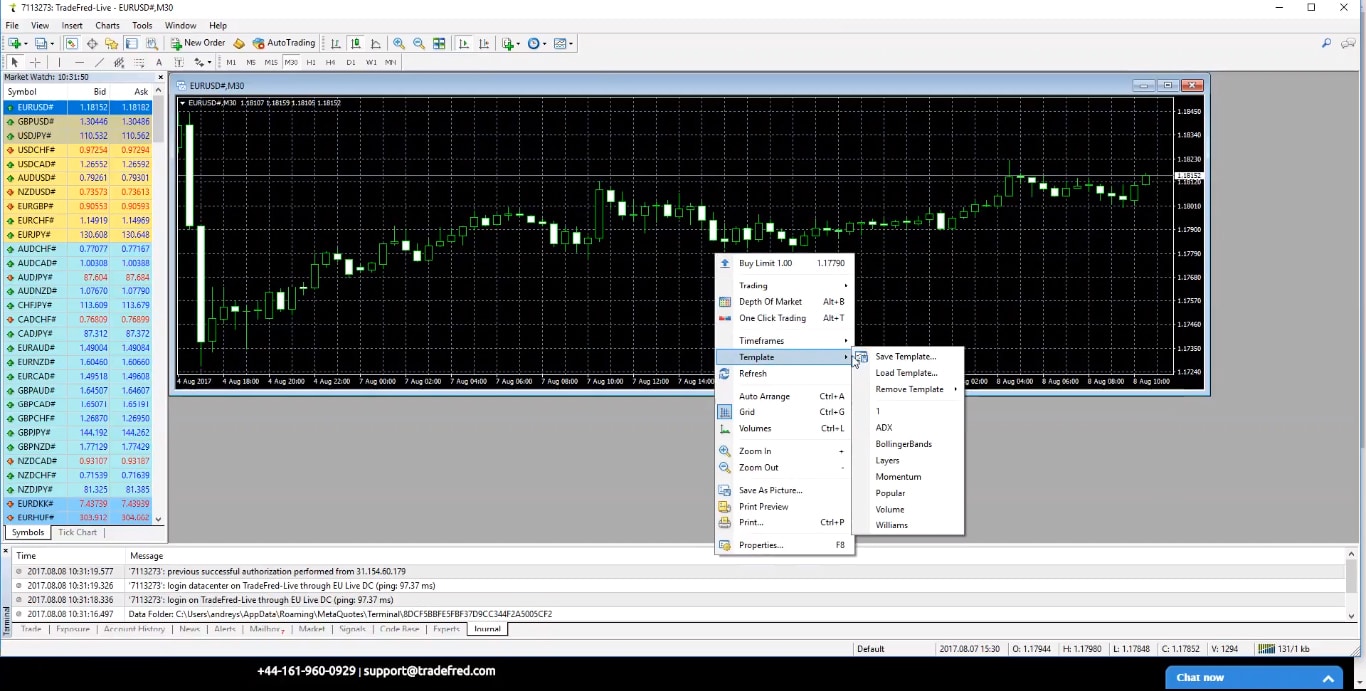

Platforms

Like every solid brokerage, TradeFred have built their platform offer around MT4. MT4 is indeed the gold standard in online trading, offering unparalleled charting and analysis tools. A wide range of time frames are available for charting, and extensive customization can be used in this regard. Traders can then save their chart templates to reuse them later.

MT4’s flexibility and power is even more evident in the matter of technical analysis. The base version of the platform comes with over 50 pre-installed technical indicators. Traders can always purchase/acquire more such indicators and install them without problems.

MT4 supports EAs (Expert Advisors) too, and for many, this feature constitutes the main draw of the platform. It is not clear however if TradeFred support automated trading too.

The Desktop Trader can be downloaded directly from tradefred.com, free of charge.

Those who do not want to download and install anything, will be able to trade through TradeFred’s Webtrader. The Webtrader is compatible with all the major browsers and it works on PCs as well as Macs. Through it, traders will be able to reap all the benefits of MT4, from any computer, anywhere in the world. The Webtrader can be launched directly from the TradeFred website.

The Mobile Trader lets TradeFred account holders trade on the move. It is compatible with all Android and iOS-based devices and it can be downloaded from the Appstore or the Google Playstore, for free.

TradeFred Account Types

The trading accounts offered by TradeFred cover every conceivable need. There’s a Demo Account, which gives traders the chance to put the TradeFred offer to the test risk-free. It comes with $10,000 in virtual funds, and it is active for two weeks. Once expired, Demo accounts cannot be re-launched. Everyone can register for such an account: this is a genuine, no-strings-attached deal.

The cheapest real money account is the Basic one, which requires a minimum deposit of only $250. The next account up the ladder is the Standard one, which features a $500 minimum deposit requirement and which offers a few more perks compared to the basic account.

The same goes for the other available accounts too: we have the Advanced, the Pro and the Premium accounts. The last one, the most expensive, is a zero-swap-account, meaning that CFDs do not mature for such account holders and they are not rolled over. The minimum deposit for this account type is $10,000. In addition to its zero-swap nature, the Premium account also gives traders better spreads.

The Islamic Trading account is a no-commission, zero-swap account, available only to traders of the Islamic faith. The Islamic account allows users to pick any of the above described accounts.

TradeFred Promotions

TradeFred offers its users the opportunity to claim back up to 50% of the fees they pay out through the spreads. To be eligible for the 100-trade cash reward, traders need to log at least 100 trades within a quarter. The higher one’s account-tier, the more rebate he/she will get.

The Birthday Cheque promotion hands qualifying traders a $25 gift on their birthdays.

Conclusion

With its new regulatory status in place, TradeFred is increasingly looking like a very competitive trading destination. Its platforms are great, its asset selection is decent and its overall reputation is spotless. The spreads could be a little smaller though.

Read more currency broker reviews

Your capital is at risk

Your capital is at risk