Swiss Markets was created as the trading unit of BDSwiss Holding PLC, which was founded in 2012. The company began operations as a brand in 2016 and was founded with the goal of creating a brokerage for traders to execute transactions in a reliable and secure environment, with the capability of trading in multiple markets via an STP or Straight Through Processing broker.

The company offers its customers the highest quality service with the critically acclaimed MetaTrader4 trading platform. Swiss Markets’ intention is to provide their clients with as many instruments as possible by providing both forex trading and CFDs on precious metals, energy products, commodities and market indexes.

A screenshot of the Swiss Markets official website can be seen below:

Please note that SwissMarkets.com currently does not accept U.S. clients. If you live in the United States, you are advised to seek another broker.

Features

Swiss Markets offers its customers an extensive list of tradable assets, including 18 major, 19 minor and 40 exotic currency pairs in the forex market, energy products including US oil, Brent crude and natural gas; commodities such as cocoa, coffee, copper, cotton, orange juice and sugar; precious metals including gold, silver, platinum and palladium; and 23 of the highest volume stock indexes that include the SPX500, GBR100 and JPX225.

The company charges commissions on transactions, with the amount of commission varying according to the account type and the base currency. Commissions per transaction can be as much as $11.00 USD, however, the broker offers competitive dealing spreads, which average between 0.2 pip for EUR/USD to 2.4 pips for GBP/NZD, it highest dealing spread among the major currency pairs.

Dealing spreads for exotic and minor pairs vary considerably depending on market liquidity. Lot sizes available to trade have a maximum of 50 whole lots per ticket and a minimum of as small as 0.01 (micro lot). Three of the four account types allow leverage of 200 to 1 in all currency pairs, while the Classic account allows leverage of up to 500 to 1, also in all currency pairs.

Accounts

Swiss Markets offers its clients four different types of trading accounts, the Classic STP account and three RAW STP accounts with distinct features and requirements. All Swiss Market accounts can be opened in the following base currencies: CHF, DKK, EUR, GBP, NOK, PLN, SEK and USD. The four account types also have an Islamic option and are listed below:

- Classic STP – a minimum deposit of $200 is required to open this type of account. Commissions for the Classic account were not published by the website, saying that they were contingent on the base currency. Dealing spreads for this account can be as low as 0.9 pips on EUR/USD. The Classic account allows for the high maximum leverage of the four at 500 to 1, with position limits of 200 per currency pair and a maximum of 50 lots per order ticket.

- RAW STP SWISS11 –this account requires a minimum deposit of at least $200 and shares many of the details of the Classic account, with the exception of a commission charge of up to $11 per transaction depending on the base currency. Dealing spreads for this account are as low as zero pips on EUR/USD and the maximum leverage for the account is 200 to 1.

- RAW STP SWISS8 – the minimum deposit required for this type of account is at least $2,000. The broker charges a maximum of $8 commission per transaction with a top leverage of 200 to 1. Spreads as low as 0 pips on EUR/USD, with the same position limits and lot restrictions as the Classic and SWISS11 accounts.

- RAW STP SWISS 5 – the broker’s premium account has a minimum deposit of at least $10,000. A maximum of $5 commission is charged per transaction with a maximum leverage of 200 to 1. Dealing spreads for this account are as low as zero pips on EUR/USD. Position limits and lot restrictions are the same as the previous three account types.

Transactions

Opening an account at Swiss Markets requires a minimum deposit of $200. Clients can make deposits using a wide array of deposit options that include Visa, Maestro and MasterCard credit cards, and electronic payment services like postepay, SOFORT, giropay, eps, Skrill (formerly Moneybookers), Przelewy24 and Neteller, in addition to a Swift Bank Wire Transfer. Deposits do not incur a charge and are generally credited to a client’s trading account immediately, other than bank wire transfers that can take from one to four days to finish.

Processing a withdrawal usually takes 24 hours and also does not have a fee associated with it. Clients must submit the appropriate documentation for verification first, and funds can then be withdrawn only to the account from which the trader initially made a deposit. Client funds can for example be withdrawn to Visa and Mastercard credit cards, Skrill and Neteller payment services, and using a Swift Bank Wire Transfer.

Platform

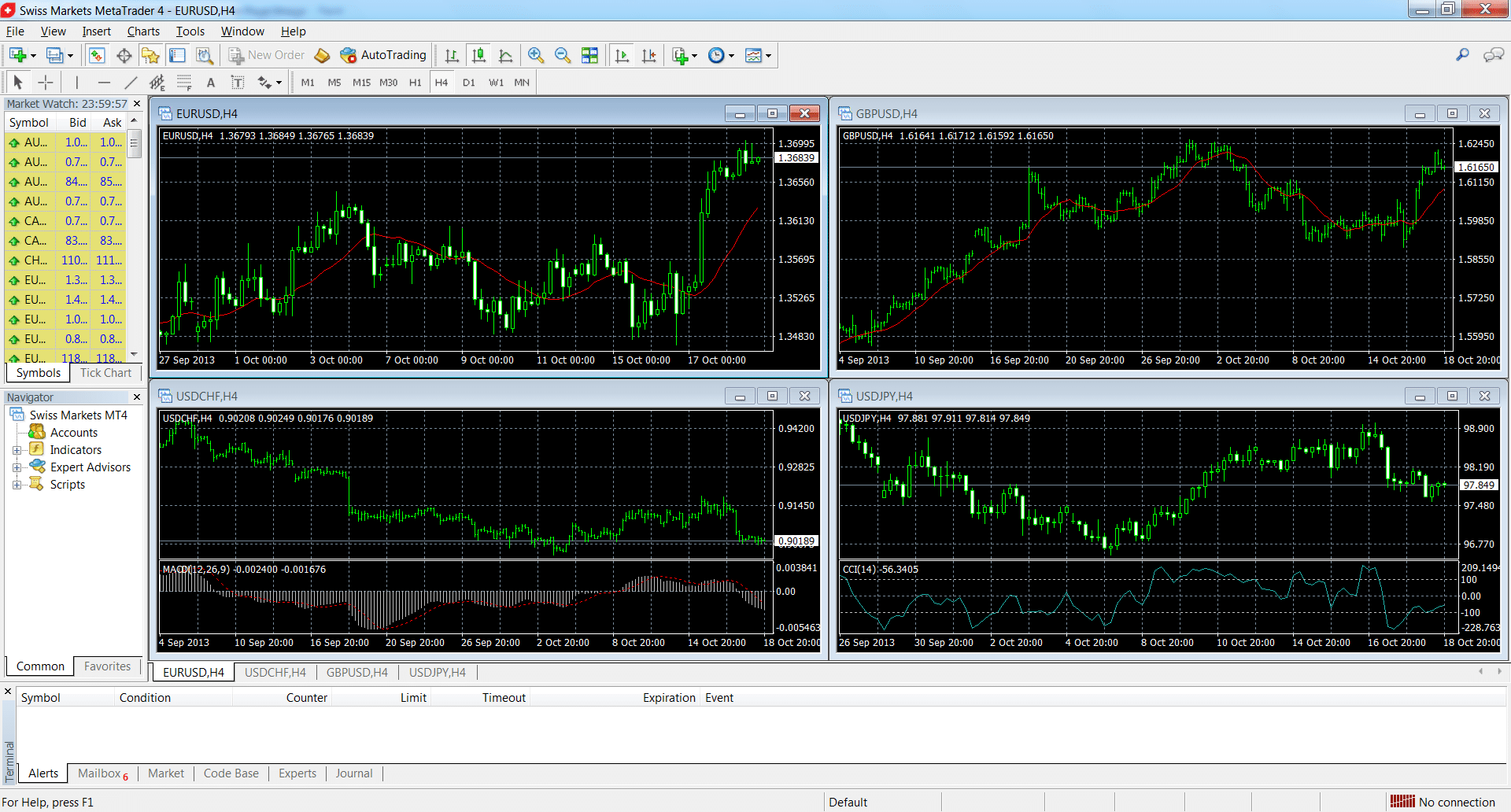

Swiss Markets offers its clients a customized version of the world’s most popular trading platform — MetaTrader4 from MetaQuotes that is used for all trading purposes. The MT4 trading platform is the current industry standard employed by most online forex brokers and traders.

The MT4 trading platform not only available in downloadable and web-based formats for Windows and Mac desktop computers, but it is also available in a mobile app version that runs on iOS and Android mobile devices.

Basically, MetaTrader4 offers everything a technical trader needs in a trading platform, providing both on screen trading, charts, indicators and the ability to view multiple assets at the same time. Traders can even manage positions, view profit and loss in real time, create custom indicators, and automate and backtest trading strategies.

When combined with the tight pricing Swiss Markets’ Straight Through Processing offers, having direct access to the markets through the MT4 trading platform becomes a very powerful combination for any trader. A screenshot taken from Swiss Markets’ customized MT4 trading platform is shown below:

Customer Support

Swiss Markets’ customer support page lists direct contact telephone numbers for Germany, the Czech Republic, Switzerland, Poland, the UK, Spain, Russia and Hungary. A UK fax number is also available. Although the broker’s “Contact Us” page does not list its customer support hours, it does provide several email addresses that can be used to contact them.

The broker’s website does feature a Live Chat button, but it did not seem to be working when tested for this review. Nevertheless, a response was received by email several hours after the original question was emailed to them

Information

Swiss Markets offers some helpful information on their website about their own products and services. They do not seem to provide any market commentary, analysis or a news feed on their site.

Educational

Swiss Markets’ “About Us” section indicates it offers some educational material that might help novice traders in their learning process, such as seminars, trading-related content and webinars, but that information does not yet seem to be readily accessible on their website.

Safety

Swiss Markets’ parent company BDSwiss Holdings PLC is incorporated and registered in Cyprus under incorporation number HE300153 and is regulated by CySEC (the Cyprus Securities and Exchange Commission) with license number 199/13.

Like any Cyprus investment firm, Swiss Markets needs to follow all relevant European and local regulation and laws, including the Markets in Financial Instruments European Directive or MiFID. The broker also needs to comply with the European Union’s Law 144(1)/2007, which is also known as the Investment Services and Activities and Regulated Markets Law of 2007.

For added safety, Swiss Markets provides its trading clients with “Negative Balance Protection” that means their account balances cannot go negative no matter what underlying market conditions may be. As another safety feature, the broker’s CySEC oversight requires that all customer funds must be maintained in accounts segregated from those of the broker.

Overall

Swiss Markets certainly gives a strong impression of being a top-notch online forex and CFD broker aimed at more advanced traders. The company offers a demo account for testing purposes, as well as four other account types that can all be set up in an Islamic format. They also waive all trading commissions for 14 days after a live account is opened as a starting bonus.

Additional benefits are that the broker offers very competitive STP pricing and deal execution via the popular MetaTrader4 trading platform, which is going to be attractive for many price sensitive traders. Their main downside is the commission charged per trade that can add up for frequent traders like those using a scalping strategy.

In addition, the live chat service button was not functioning to get customer service with, which can be frustrating if you prefer to use that method, and the educational material mentioned in the broker’s “About Us” section does not seem to be located on the company’s website yet.

Overall, Swiss Markets would probably make a good broker for an advanced and price sensitive trader who does not require educational materials or plan on trading very frequently.

Your capital is at risk

Your capital is at risk