Based in Cyprus, CAPEX is a relatively new brokerage, judging by its CySEC license, which was granted in 2016. It offers only two trading platforms: a Web Trader and MT5. The trading product selection is great and the whole operation is focused on transparency: all the legal documentation pertaining to the operation has been made available at the site.

CAPEX are allegedly focused on transparency and the security of trader funds. Monies deposited by users are kept in segregated bank accounts, and every bit of information shared by users through the site is protected by top-notch encryption. Although the name of the brokerage would indeed suggest a global operation, CAPEX is only authorized to provide financial services within the European Economic Area. Even within this zone, its regulatory profile is less prominent than most of its competitors’.

The corporate operator behind the CAPEX brand is Key Way Investments Ltd. Headquartered at 2 Sofouli Street, Chanteclair Building, 6th Floor, Office 602, Nicosia, Cyprus, Key Way’s CySEC license number is 292/16. In addition to this CySEC license, CAPEX is registered with a handful of other EEA-based national regulatory agencies too, such as the UK’s FCA, Poland’s KNF and Germany’s BaFIN. Registration does not mean that all those authorities have granted the brokerage an operating license though.

In regards to trader fund safety, it also has to be mentioned that as a Cyprus Investment Firm, CAPEX is a member of the Investor Compensation Fund. This way, it essentially offers protection to its clients against a sudden bankruptcy, or any other unexpected event that may result in the inadvertent loss of trader funds.

CAPEX Trading Conditions

Whenever you ask yourself the question “why should I trade with this broker?”, the answer starts with the trading conditions. This is after all the most important quality factor concerning any trading experience, right after regulation and trust. At CAPEX, there is full transparency in this regard as well. There is a page where the trading conditions are all put on display, for every single tradable asset.

On Forex pairs – though it is said that the maximum available leverage is 300:1 – the leverage is actually variable as are the spreads and the overnight rollovers.

On a major, like the AUD/USD, the spread is set to 3 pips (which is not exactly tight, but one has to bear in mind that there are no commissions charged on this asset class). The maximum leverage on the same pair is 1:295.

On the EUR/USD on the other hand, the spread is just 2 pips (still rather on the steep-side), while the maximum available leverage is the same (1:295).

On pairs like the USD/SEK, the spread is extremely high – there is just no way around this fact. At 50 pips, it cannot be called tight, not even with the greatest lenience. The maximum available leverage on this pair is 1:200.

There are more exotic pairs on which the trading conditions are still more adverse. An example in this regard is the EUR/CZK pair, on which the spread is 350 pips. The maximum available leverage on this pair is just 100:1.

On shares, the maximum available leverage is 1:10. The spreads are variable on these assets too. On Italy’s A2A for instance, it is 0.01. There are around 2,000 companies supported in this section, covering most of the world, from the USA all the way to Australia, Norway and Hungary.

26 indices are also available for trading, with spreads spanning the range from 0.19 (EUR) to 40(ZAR). The available leverages on these assets are variable as well. They go from 1:10 all the way to 1:200 – depending on the traded asset.

As far as commodities go, the trading conditions are obviously variable as well. One really can’t expect the same conditions to be in place for Gold and Silver as for Soybean and Heating oil. The spreads cover a rather diverse scale here too. On Sugar for instance, the minimum spread is just USD 0.04, while on Aluminum, it is USD 10. The maximum available leverage goes from 1:10, all the way to 1:200.

Cryptocurrencies represent the newest and possibly most interesting underlying asset category. High volatility and a hyper-sensitivity to the fundamentals make the trading of this asset class very risky, but at the same time, potentially highly rewarding as well. The trading conditions featured at CAPEX for this asset class reflect these facts well. The spreads are usually pretty high. On Bitcoin for instance, the minimum spread is as high as $165, while on Ripple, it is just $0.01. The size of the spread obviously depends on the actual price-level of the currency too. The maximum available spread on cryptocurrencies is 1:2.

CAPEX Trading Platforms

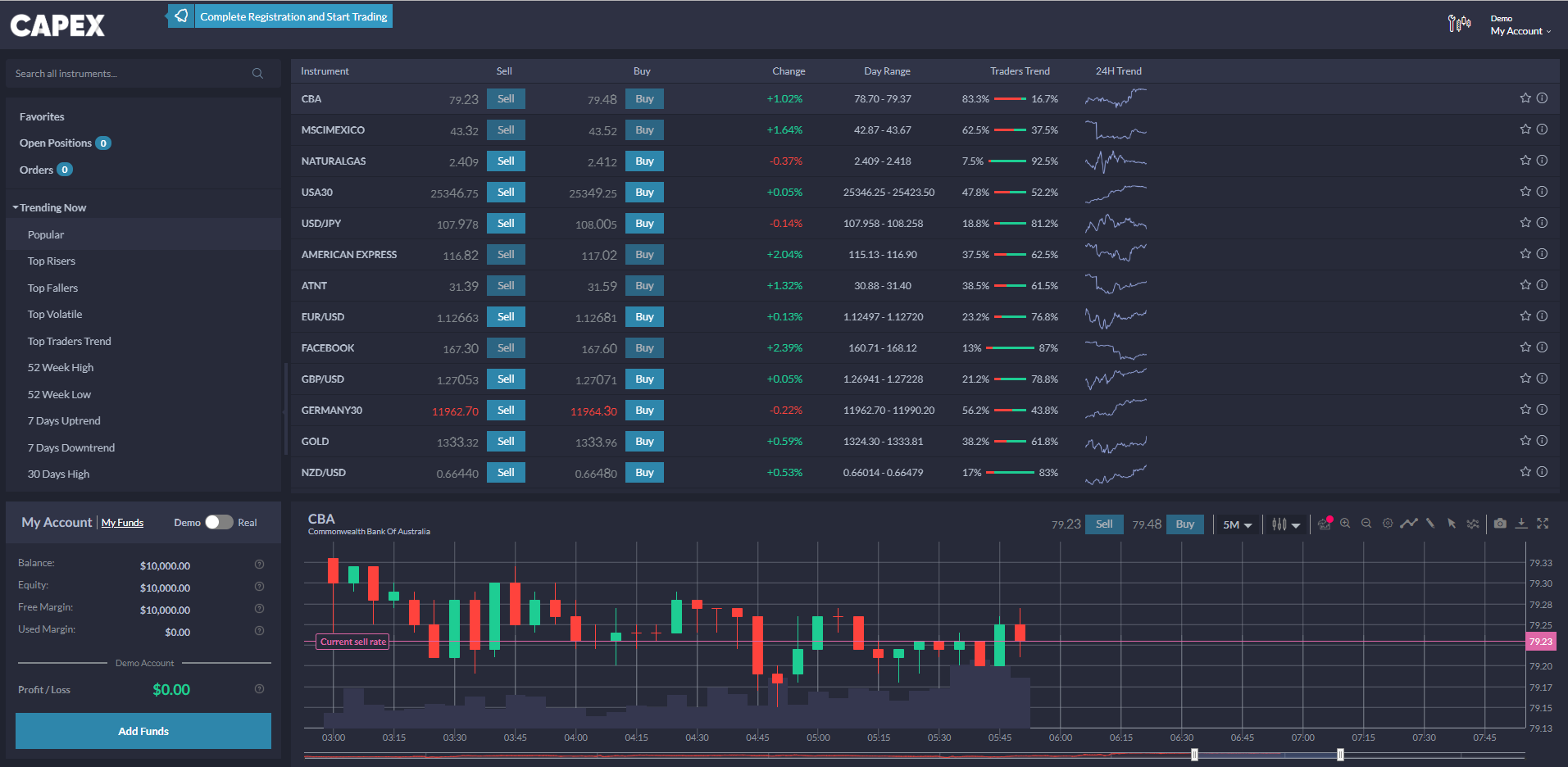

The brokerage only features two trading platforms, MT5 and a Web Trader, but compatibility is excellent with both, so all the devices clients may possibly use, are covered.

The Web Trader is designed to be the handier and quicker option: it can be accessed at a few clicks, without having to download anything, and it is remarkably powerful for a browser-based solution. In fact, it delivers all the tools and options an average trader would possibly need for analysis and actual trading. Some 90 technical indicators are included with the Web Trader. One-click trading off the charts is available, together with various drawing tools and chart types. In addition to all that, the Web Trader also features streaming live quotes and cutting-edge security features. Navigation through the trading interface is simple and handy and all the tools can be accessed directly from the main platform interface, at a single click.

Besides various browsers running on Windows PCs, the CAPEX Web Trader works with iOS- and Android-based mobile devices too.

MT5 is the flagship of the CAPEX trading platform offer. A natural evolution of MT4, MT5 brings noticeable improvements in the way users can code their custom technical indicators and EAs.

The platform – which can be downloaded from the CAPEX website for free – comes with 30 preinstalled technical indicators. While this number is definitely not impressive, it can be rounded out for free, from a selection of more than 2,000 technical indicators. A total of 9 time-frames are available for charting and the customization options featured by the platform are simply unmatched. Traders can create chart templates, and by saving them, they can make them available for later use. EAs are among the main attractions of the MetaTrader platform suite, and they are indeed supported by CAPEX’s MT5 as well.

CAPEX Account Types

Besides the free Demo Account, which works with the Web Trader as well as with MT5, CAPEX offers three real money account tiers. The Global Essential account is the basic one, requiring a minimum deposit of $1,000.

The Global Original account ups the stakes to $5,000 and it throws trading alerts and event analysis into the mix.

The Global Signature account is obviously for high-volume traders. It requires a minimum deposit of $25,000. For that kind of money, traders who sign up for this one, get 24/5 support, in addition to everything else.

Read all currency broker reviews

69,85% of retail investor accounts lose money

69,85% of retail investor accounts lose money